Following over a decade of previous and successful annual events, ACC25 – the Asian Claims Convention – was held in Osaka, Japan on 13–15 May 2025.

Attended by insurance industry and claims management professionals including insurance managers, brokers, re-insurers, loss adjusters, professional consultants, insurance lawyers, suppliers and service providers, ACC25’s theme was ‘Traditional Claims Management in a Digital Age.’

The convention comprised a high quality two day program of events and presentations which examined the challenges facing those in insurance claims management and took a look at best practice across the industry with a particular focus on Asia, and so Scott Reichelt was invited to make a presentation on the second day.

Subjects ranged from risk management to the importance of soft skills to a view of what financial impacts a future global pandemic might bring. In considering what his own theme should be, Scott spotted a common denominator across all the other presentations.

Explains Scott: “While the subject matter was quite varied, the rise of AI and the increased availability of sophisticated Insurtech was a common thread as the insurance industry is advancing at speed into a digital future. This means an ever-growing reliance on the hardware that drives the technology – and that’s just as true for systems all around the globe, not just the insurance sector.”

With this thought in mind, Scott delivered a presentation under the title of ‘Unsteady Ground – Chip Manufacturers and Earthquake Losses.’

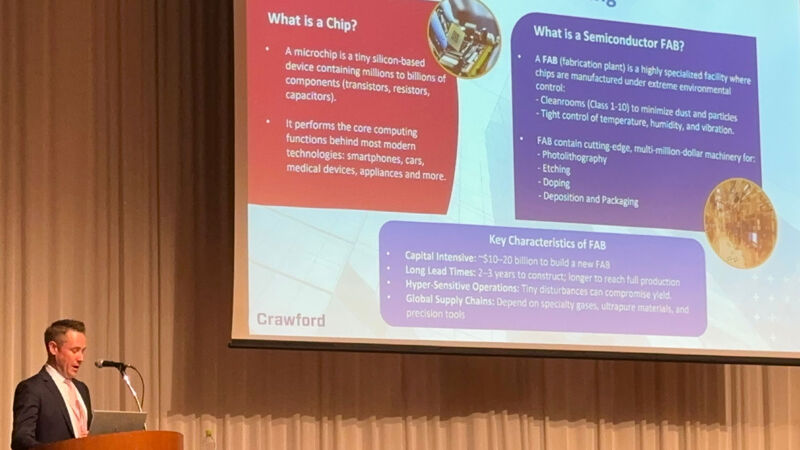

Scott adds “Silicon chips and semiconductors are essentially the foundations on which all global digital infrastructure is built. The fabrication plants that produce them are highly specialised facilities that operate under very specific conditions – dust particles are scrubbed from the air, temperature and humidity are strictly controlled and vibration is reduced as much as possible. That’s because tiny disturbances can compromise quality of output and even a brief shutdown can trigger a global domino effect.”

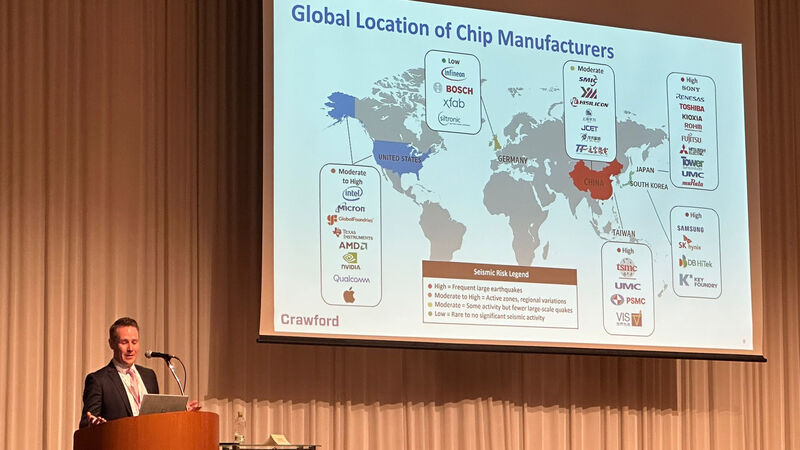

Many of the world’s chip manufacturing plants are based in China, Japan, Taiwan and South Korea – all areas of frequent seismic events. With five episodes of major earthquake activity in the region since 2021, some of which caused structural or equipment damage and either slowed or halted chip production, the threat to the global supply chain is only too real.

“Earthquakes don’t respect geographic boundaries or discriminate between manufacturing sectors,” observes Scott.

“I’ve seen a marked increase in the scale and complexity of losses right across the region, so for some time now we’ve been growing the Crawford Global Technical Services team in Asia with a focus on strengthening technical expertise and developing our ability to scale our services up at pace when these natural catastrophes strike.”

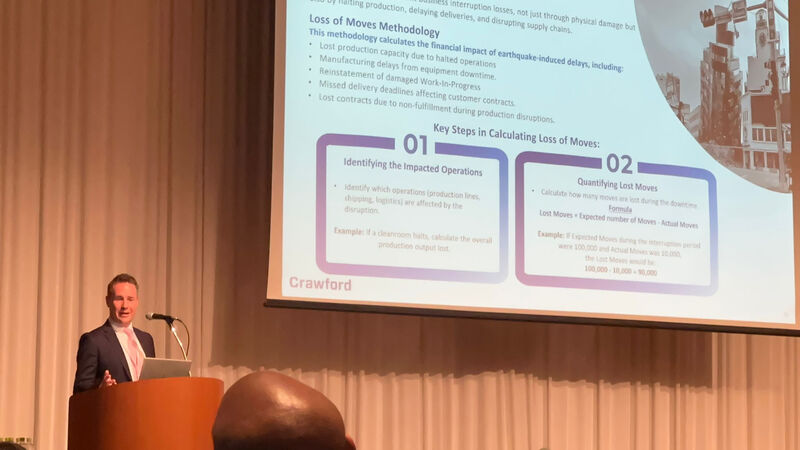

Scott’s presentation covered examples of potential loss scenarios including structural damage to plant buildings as well as the impact of failure in the vital infrastructure and support facilities – loss of power and failure of a back-up supply can lead to loss of automated quality controls, air handling and vibration damping systems, as well a loss of security and intruder detection alerts. There’s also a heightened risk of plumbing failures that might trigger an escape of water. And even if stored stocks of chips remain undamaged and worth salvaging, compromised local transport infrastructure may still cause disruptive delays in viable chips finding their way back into the supply chain.

With growing concerns for earthquake risk, there is also a growing threat to chip production and the global supply chains that they feed into. Mitigating these risks is complicated by the highly specialised chip manufacturing equipment as well as the strictly controlled manufacturing processes and environments.

Repairs to plant buildings may not necessarily be straightforward, while replacement machine parts often carry long lead times and high costs, leading to significant business interruption claims. Delays in procuring replacements can extend downtime and their high costs can significantly impact a company’s financials, particularly if there is a need for rapid repairs to allow production to recommence.

Scott advocated for a focus on advanced risk planning though customised modelling, allied to the development of tailored, sector-specific insurance products for both property and business interruption losses. In tandem with these, there is also a need for stringent business continuity planning – building in redundant systems, lining up alternative suppliers and possibly considering geographic diversity into more seismically stable areas.

“This is a sector with a lot of moving parts that take a lot of understanding,” adds Scott. “As a business, Crawford has led the industry through a relentless focus on the quality of our people and the innovative digital tools that empower them – so we know better than most how important technology is to the insurance sector. That’s why our focus is not on training insurance people to become hi-tech industry experts. Instead, we’re teaching the insurance business to selected experts who can then speak with clients about technical issues on a peer-to-peer level, leading to a faster and better understanding of the loss and elevating our customer service”.

In summary, Scott observes “the size and complexity of losses in the sector has led to reinsurers and brokers becoming more involved in the claims process, requiring our adjusters to engage with larger claims panels. I think it’s really important for insurers and brokers to have a thorough understanding of the complexity not only of the risk, but also the loss scenarios and how losses can flow from an event, how they can be mitigated and how reinstatement will take place. Brokers prepared to act as risk partners to their clients can play an important role in scenario planning, walking clients through the maximum foreseeable loss and how it would play out”.